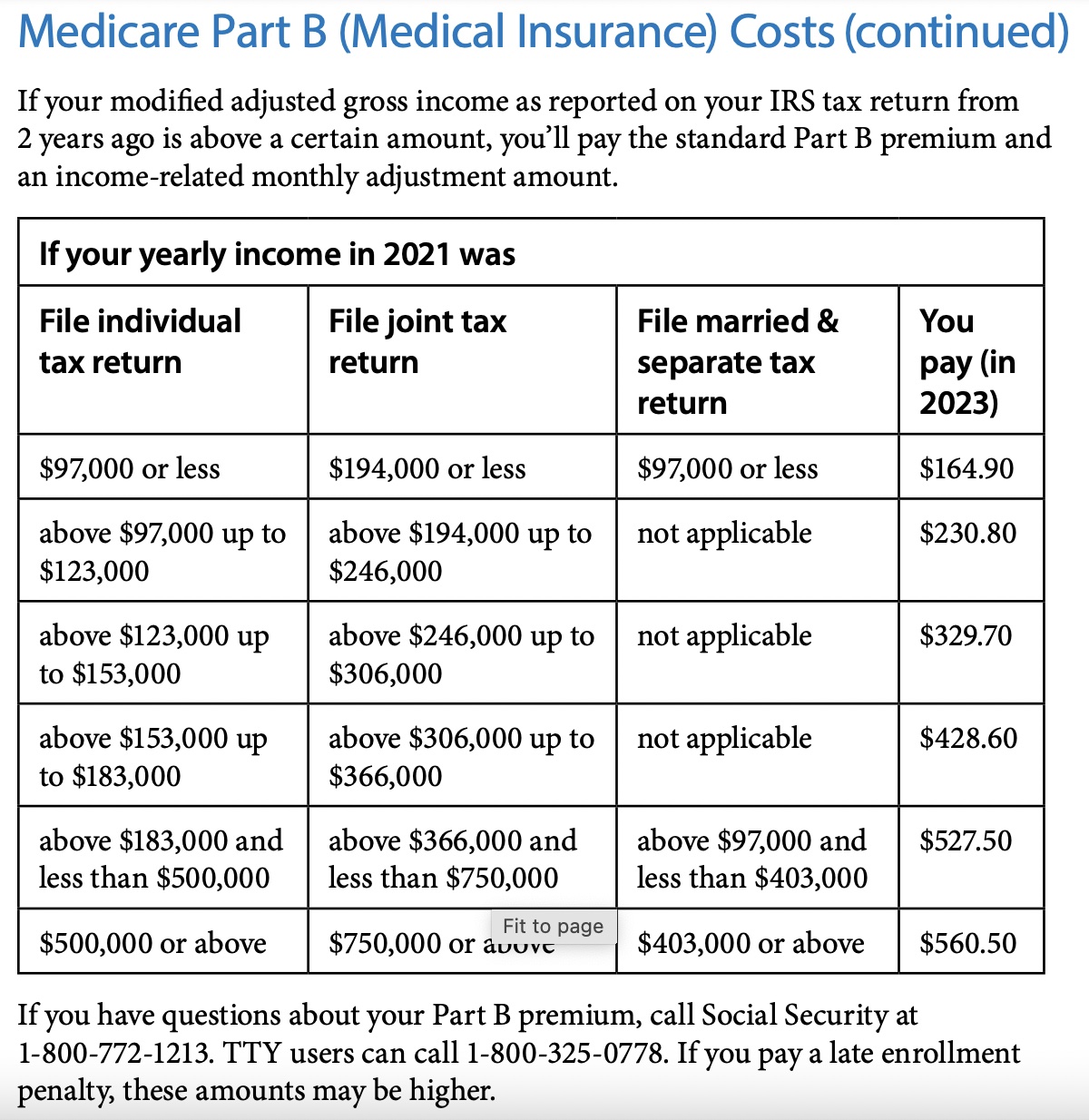

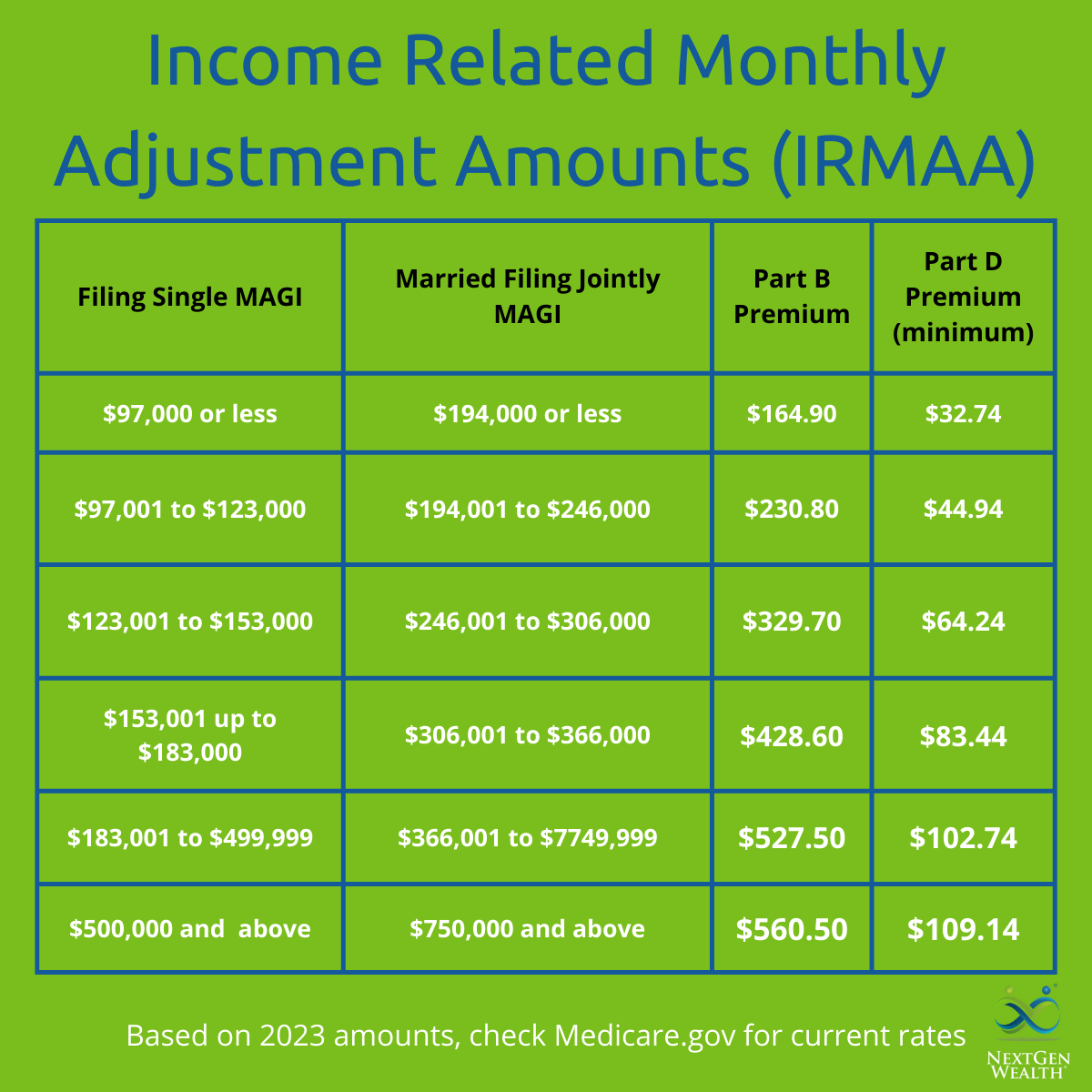

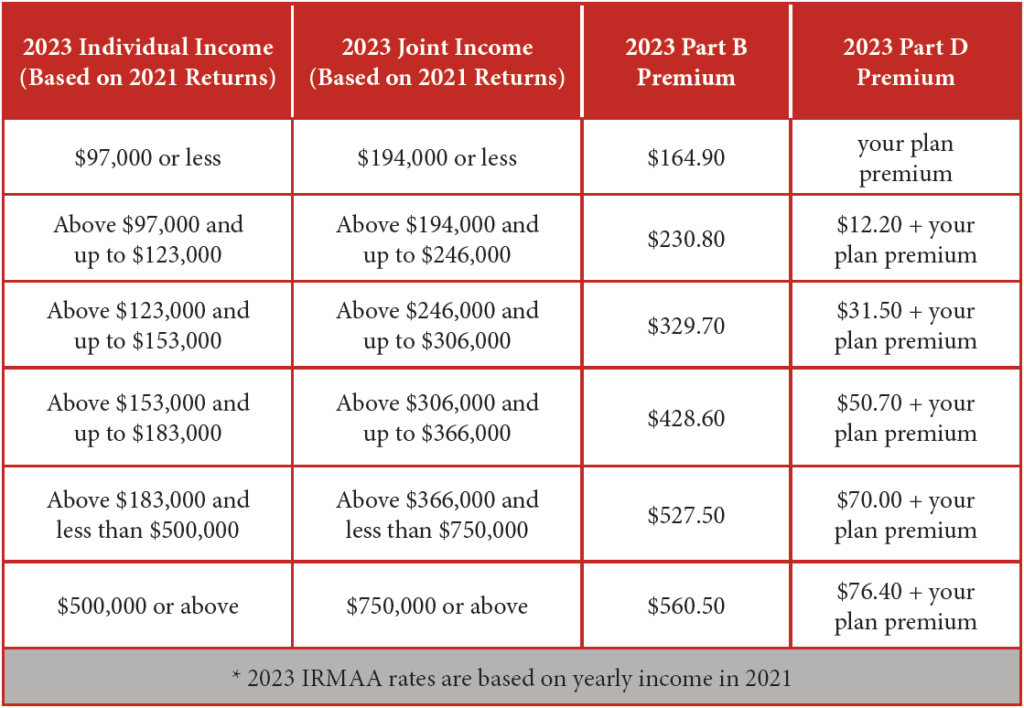

Irmaa Brackets 2025 Married Filing Jointly Over 65. The table below provides the projected irmaa brackets for 2025 (based on your 2025 yearly tax returns). In 2025, you qualify for irmaa if your income exceeded $106,000 as an individual or was more than $212,000 as a married couple.

For 2025, if you file taxes as an individual and your magi is over $106,000, or if you file jointly and your magi is over $212,000, you will owe irmaa. If you’re single and your magi is.

Irmaa Brackets 2025 Married Filing Jointly Dominic Edmunds, Irmaa is reassessed annually based on your most recent tax return.

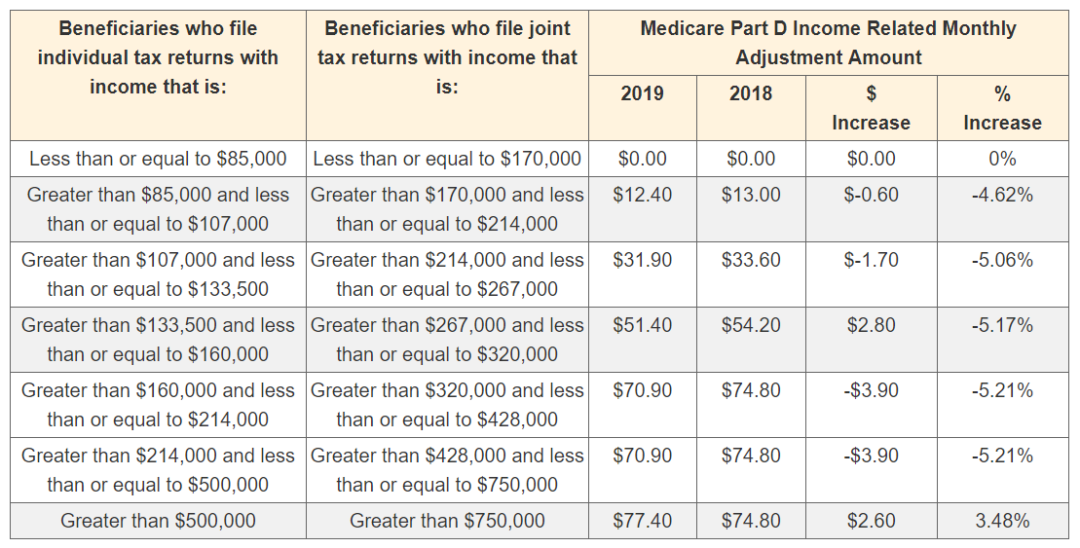

Irmaa Brackets 2025 Married Filing Jointly Dominic Edmunds, The irmaa calculation uses three tax filing options:

Medicare Irmaa 2025 Brackets And Premiums Kylie Allan, For example, if your modified adjusted gross income (magi) exceeds $97,000 for individuals or $194,000 for couples filing jointly, you will likely see an increase in your.

Irmaa Brackets 2025 Charter Roxy Wendye, Both individual and joint filing statuses are considered.

Tax Brackets 2025 Married Jointly Over 65 Jasmine Parsons, Learn about medicare irmaa 2025 brackets, how they're calculated, and how they impact your medicare premiums.

2025 Irma Brackets Married Jointly May 2025 Printable Calendar, The irmaa calculation uses three tax filing options:

Estimated 2025 Irmaa Brackets April Brietta, Individual, married filing jointly, and married filing separately.

Tax Brackets 2025 For Married Filing Jointly Dorris Betteanne, Once you have determined your inputs, you can shift.

Irmaa Brackets 2025 Married Filing Jointly Over 65 Domini Antonina, For 2025, you’ll find several distinct income brackets that determine your irmaa surcharge.