Irs Charitable Mileage 2025. The internal revenue service has released its “optional mileage rates” for 2025. 67 cents per mile driven for business use, up 1.5 cents from 2025.

Beginning on jan uary 1, the 2025 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical, or. The allowable rate for business vehicle use tax.

Irs Standard Mileage Rate 2025 For Charitable Cassi Maryanna, Under current irs regulations, nonprofits can reimburse charitable mileage at the rate of 14 cents per mile.

/medriva/media/post_banners/content/uploads/2023/12/irs-2024-standard-mileage-rates-20231216051023.jpg)

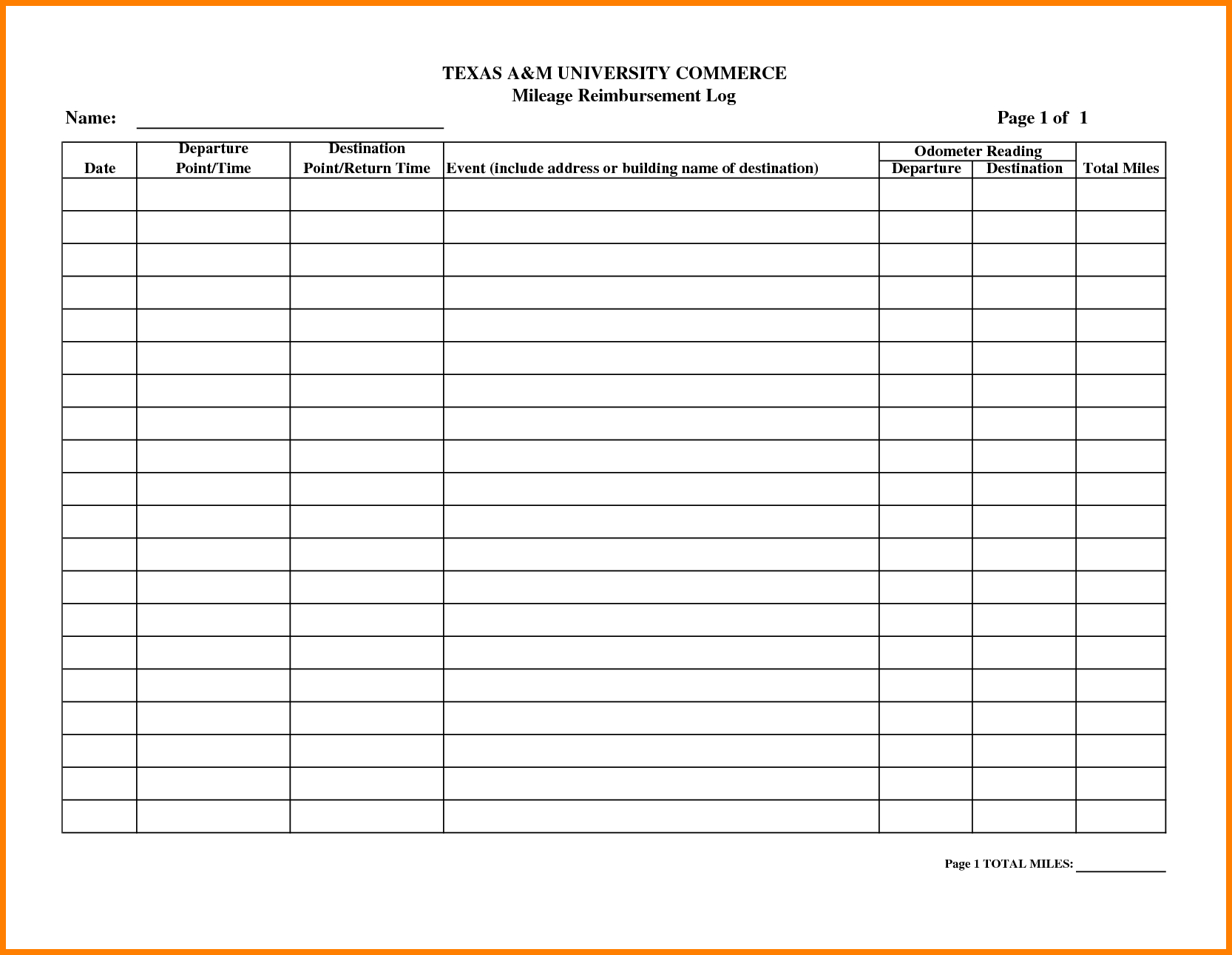

Irs Mileage Rate 2025 Calculator Flossi Rachel, Volunteers should keep records of their expenses or mileage reports.

Mileage Rate 2025 Charity Danita Wallie, The internal revenue service issued the 2025 optional standard mileage rates.

Irs Standard Mileage Rate 2025 For Charitable Luisa Timothea, 67 cents per mile driven for business use (up 1.5 cents from 2025).

Standard Mileage Rate 2025 For Charity Alissa Eleonore, 67 cents per mile driven for business use (up 1.5 cents from 2025).

Mileage Rate 2025 Charity Danita Wallie, Under current irs regulations, nonprofits can reimburse charitable mileage at the rate of 14 cents per mile.

Mileage Reimbursement 2025 Calculator Irs Elaine Courtnay, A charitable mileage deduction is a form of compensation available to taxpayers who use their vehicles to travel for charitable purposes.

Irs Mileage Rate 2025 Non Profit Aimee Atlante, The rates can be used to calculate the deductible costs of operating a vehicle for business,.

Standard Mileage Rate 2025 For Charity Alissa Eleonore, On december 14, 2025, the internal revenue service (irs) issued the 2025 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business,.